It would be outside the scope of human nature not to be at least a little concerned with how fast the markets have dropped in the last 2 weeks. Fortunately, our client portfolios are well diversified, with a substantial allocation to high quality bonds, all of which have been maintaining, or even increasing in value during this time. The end result is that portfolios are well equipped to weather the volatility.

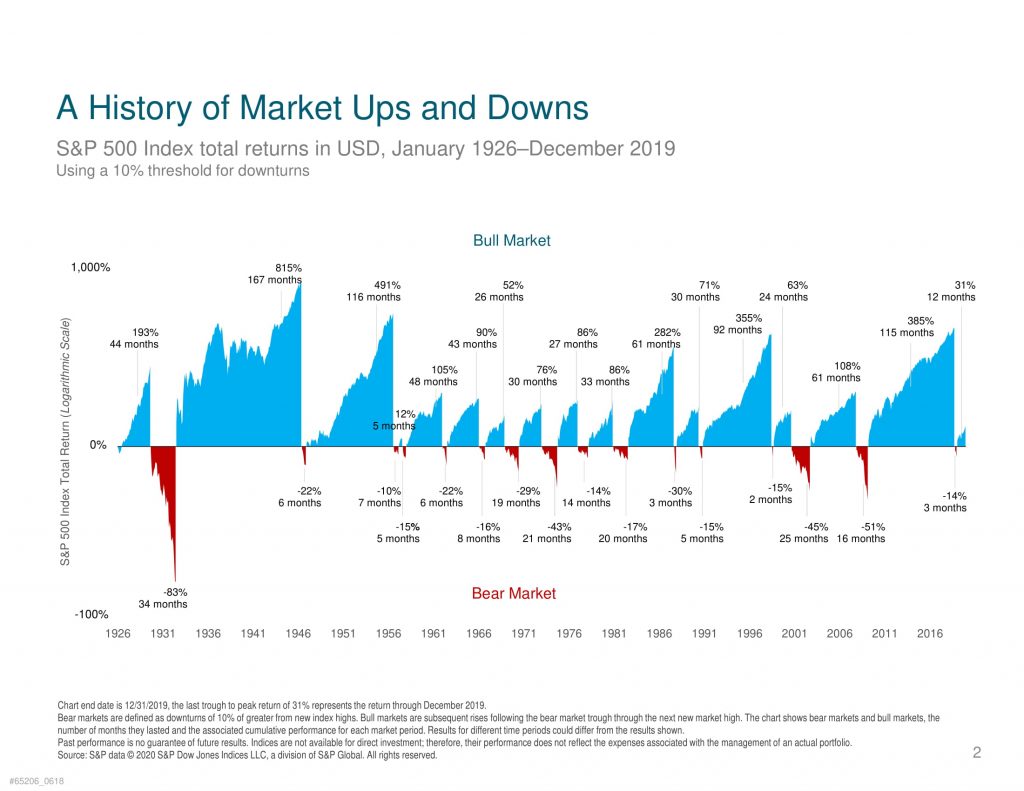

The chart below shows how time is on your side with the markets, with bull markets highlighted in blue and bear markets in red…

The reality is that buying opportunities in these red zones do not come around very often. We have already taken opportunities to buy low and we are currently preparing to do so again. By maintaining this discipline, portfolio value will be restored much more quickly when the market rebounds. Any alternative strategy, such as selling equities during this environment, would not allow the recovery to occur as quickly and the odds for success would go down dramatically.

Even with all of this perspective, it doesn’t make the drops much easier to watch. But there is no doubt in any of our minds that markets will recover at some point. We will be using this time to position your portfolio to capture as much of the recovery as we can while continuing to protect from any permanent losses.

Lastly, keep in mind, our approach is not one where we are buying individual securities. If that were the case, then most of what is described above would go out the window. It is only because of how diversified the portfolio is currently that this strategy will work.