Although the stock market has lost value recently, the good news is that we are always prepared for these types of events by maintaining a diversified portfolio with a substantial allocation to multiple bond asset classes. The bond asset classes have actually increased in value over the last couple of months. The equity asset classes have temporarily declined, but to the extent that you still own the shares, these values will be restored when the markets rebound.

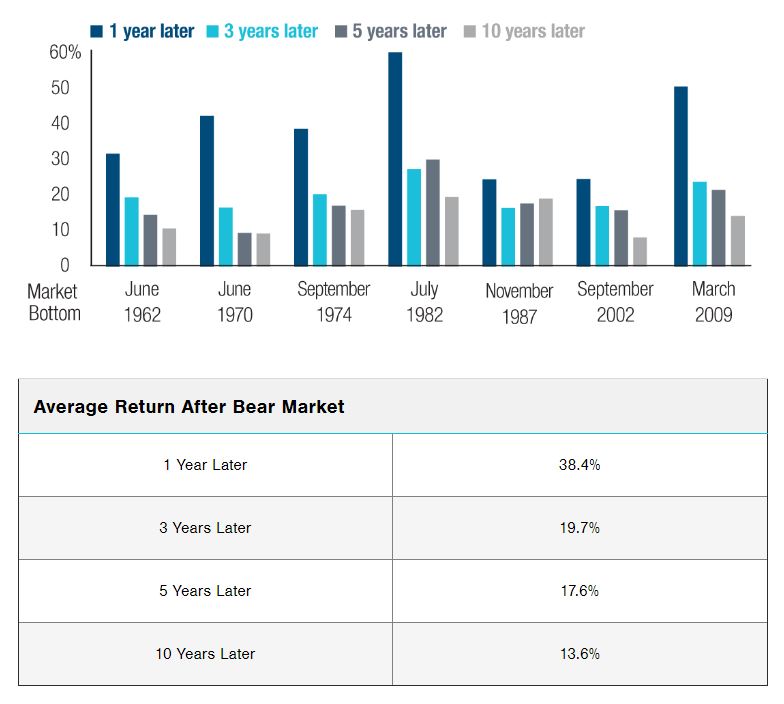

Declines of the recent magnitude are known as a “bear market” and most often associated with a recession. Therefore, if a recession does actually materialize, the markets should not be falling much further from current levels. If, however, the markets are incorrect and have retreated farther than they should have (as we suspect), then a bounce-back will likely occur sooner rather than later. Sometimes markets decline more than they otherwise should because of fear, uncertainty of the future, or both. Most importantly, in these circumstances, the subsequent rebounds are often swift and tend to come in quick, intermittent bursts. In any case, as shown in the chart below, one year after a typical bear market, the average rate of return has been over +38%. In addition, the 3-year period following the bear market has provided an average annual return of about +20% and almost +18% per year over the subsequent 5 years. Failing to participate in this rise can be damaging to meeting your savings goals.

The markets will continue to be volatile, but the opportunity for significant growth over the coming months and years is a reality.