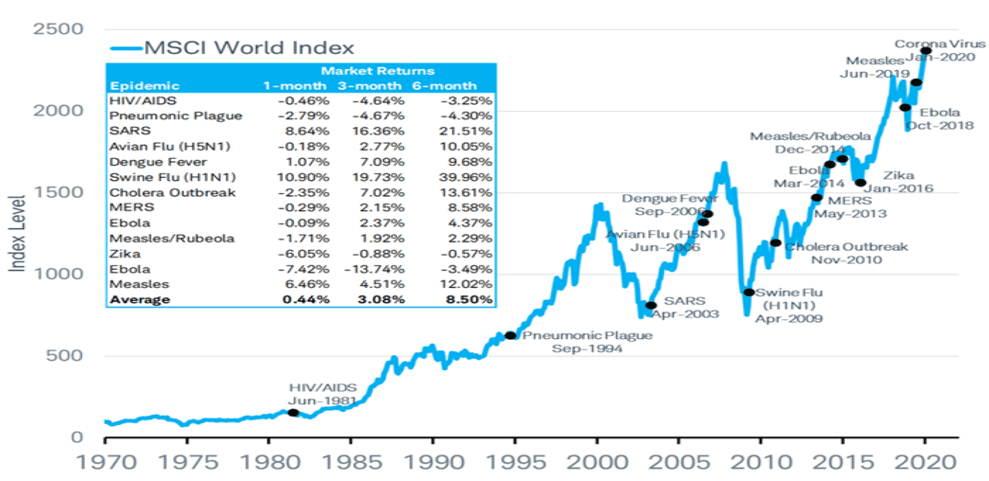

The recent news regarding the coronavirus is concerning and we are hopeful that this epidemic ends quickly. From an investment standpoint, the news has resulted in market volatility that we have not experienced for a couple of years. The MSCI Index, which is a broad measure of the world stock market, is illustrated in the chart below and provides an indicator of how the markets have performed during other epidemics, which are not uncommon events.

Although markets often experience an initial decline after the start of an epidemic, a recovery has typically occurred within a period of a month or less. After 3 and 6 months, it has been highly unusual for the markets to still be in a negative territory.

It is important to note that the markets have been experiencing significant advances over the last several years, particularly in 2019. During this time, we proactively harvested profits and protected those gains by allocating them to the more conservative areas of the portfolio such as short and intermediate term bonds. Volatility is likely to continue, but a diversified portfolio along with proactive management will prevail.

If you have any questions or concerns, please do not hesitate to email or call us.