With many stock indexes such as the Dow Jones Industrial Average and the S&P 500 hitting new market highs, some investors may be nervous that the advances cannot continue. In our opinion, bull markets do not die of old age and the fact that a market is hitting a new high does not, in and of itself, provide a negative signal.

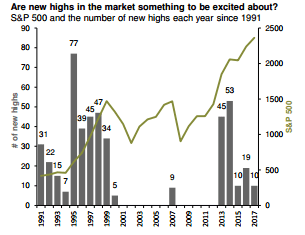

The chart below illustrates how market highs are not historically uncommon, and suggests that they can be sustained for long periods of time in the right economic environments.

Source: J.P. Morgan Research

The chart illustrates that in many years new highs have been achieved 30-50 times a year and can continue for a full decade. In 1995, the stock market even hit a new high 77 different times. By comparison, since the economic recession in 2008 we have not hit record highs nearly as frequently.

If these market advances were accompanied by extraordinarily high valuations, this might create a concern. In the late 1990’s for example, Treasury Secretary Alan Greenspan coined the term “irrational exuberance,” which was his terminology for describing an overvalued stock market. At that time, in spite of companies reporting very low earnings, the markets advanced for several years. Eventually a market correction occurred from 2000-2002, but the markets advanced for several years prior to doing so.

Today, the market appears to be much different. Valuations are currently at reasonable levels, economic fundamentals continue to improve and recent earnings reports by companies have been relatively strong. Further, given that inflation is very low, the value of these earnings is not being diluted by the rising costs of goods and services. For these reasons amongst others, our expectation is that although short-term volatility may arise, the markets can continue to advance beyond today’s levels for some time.

About the Author: David Wilder

David D. Wilder CFP®, CTFA, MST, AIF®, CEPA – Principal & Chief Investment Officer As Chief Investment Officer, Dave chairs Total Wealth Planning’s Investment Policy Committee and leads and manages the investment management team. He is primarily responsible for investment research, preparing and communicating Total Wealth Planning’s economic and investment outlook. As Principal, Dave is responsible for investment advice, with extensive client contact and client-relationship management. He has a Master’s in Tax Law (MST) from Villanova University and is a CFP®, a Certified Trust and Financial Advisor (CTFA), and a Certified Exit Planning Advisor (CEPA).