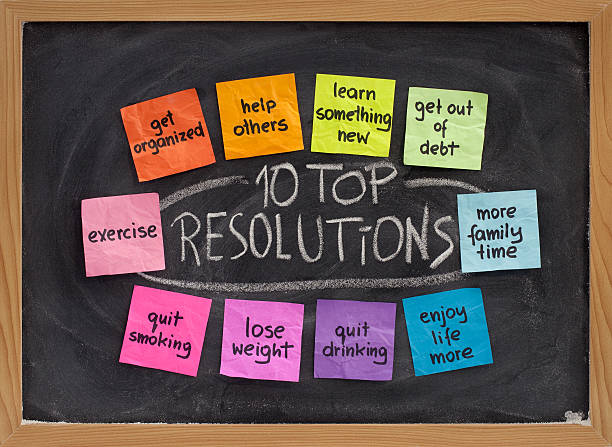

It’s that time of year when many of us think about establishing one or more New Year’s resolutions.

This often means committing to improving one’s lifestyle by eating healthier, exercising more, or spending more time with family. Many investors could benefit from resolutions targeting their financial health as well. Just as many individuals endanger their well-being with bad habits, numerous investors suffer from holes in their financial plan, or worse, ill-advised practices that are detrimental to their wealth. Everybody wants to be healthier, and many people want to be wealthier, but it takes commitment and discipline.

Most of us find it hard to follow a sensible diet or a sensible investment strategy 100% of the time. If you must stray when managing your wealth or well-being, moderation is the key. A delicious cheeseburger is OK, as long as it’s not for dinner every night.

Finally, just as many athletes, executives or business owners rely on coaches and consultants to help them succeed, most investors can benefit from having a “financial coach” to remind them throughout the year about their New Year’s resolutions and keep them on track toward a more prosperous future. If you know of someone who may benefit from our team of experts’ careful eye, we hope you’ll share this blog and our videos with them. Happy New Year!

Author: Rob Siegmann is a partner and chief operating officer of Total Wealth Planning, a fee-only fiduciary financial planning firm in Cincinnati (Blue Ash), Ohio. He is often quoted in industry publications such as The Cincinnati Business Courier, Wall Street Journal, Yahoo finance, Financial Planning Magazine, Cincinnati Enquirer as well as others. Rob is grateful to serve others, including his team of CERTIFIED FINANCIAL PLANNER™ practitioners and the clients they serve, so they can live their greatest life through well informed and prudent financial decisions. Rob can be reached at rsiegmann@twpteam.com.