If you are evaluating mutual funds based on lower expense ratios (highly recommended!), then you likely will have Vanguard funds included on your list. The fund family has consistently lower expense ratios compared to most of its peers. We as a firm agree that costs matter and generally higher returns are generated from funds with lower expenses. However, one fund family that should not be overlooked as part of a review is Dimensional Fund Advisors (DFA). The expense ratios are slightly higher for DFA but returns are consistently above Vanguard’s, even after accounting for expenses.

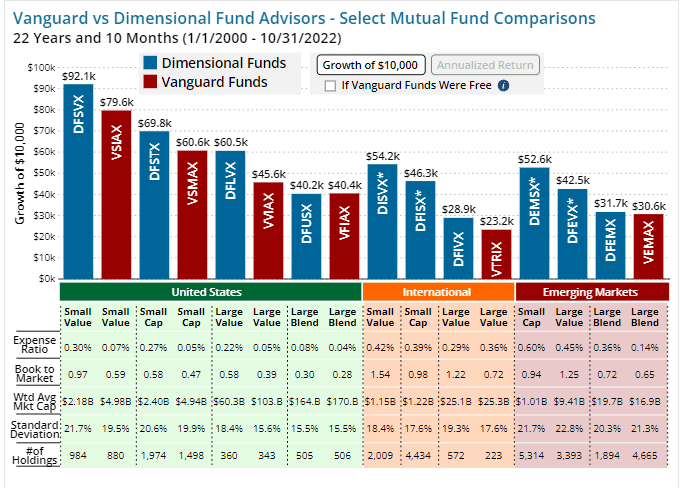

The chart below illustrates the persistent outperformance of DFA vs Vanguard, even though both of them are considered to be passively managed index funds.

In order to be able to offer DFA to their clients, an investment advisor is required to attend a two-day training session and then make a presentation regarding their investment philosophy. The purpose of the presentation is to assure DFA that the advisor’s methodology is sound and does not involve emotional decision making or market timing which in turn helps to assure DFA that they will not be disrupted when managing the underlying investments. The end result is that DFA can offer funds with very low expense ratios, and for over 20 years, DFA has persistently outperformed its peers and corresponding indexes.

If your advisor doesn’t use DFA, you may want to ask them why they do not. In the meantime, if you would like a second opinion on your portfolio from us, please contact us at info@twpteam.com or by calling our office at (513) 984-6696.

About the author. As Chief Investment Officer, Dave Wilder chairs Total Wealth Planning’s Investment Policy Committee and leads and manages the investment management team. Dave is based out of the main office of Total Wealth Planning, located in Blue Ash, Ohio. Furthermore, he has a Master’s in Tax Law (MST) from Villanova University and is a CFP®, a Certified Trust and Financial Advisor (CTFA), and a Certified Exit Planning Advisor (CEPA).